HIGHLIGHTS

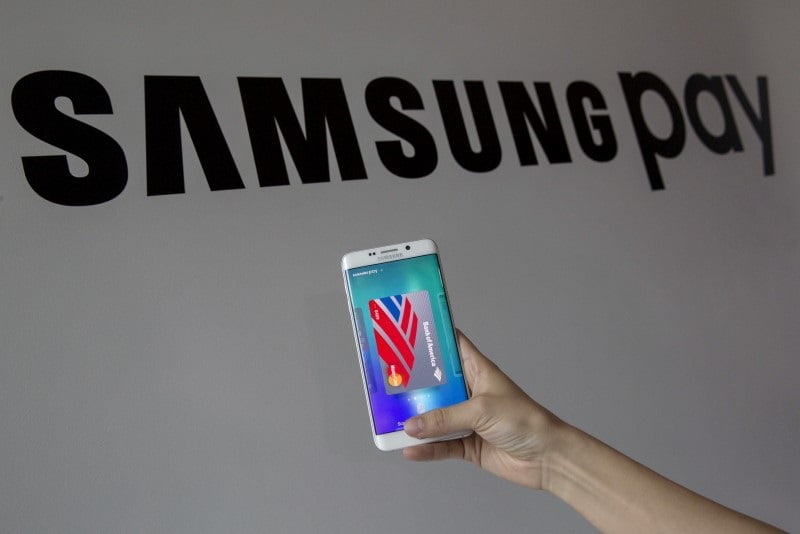

Samsung Pay had processed greater than $1 billion in South Korea.

Magnetic Relaxed Transmission era offers Samsung an part in US.

Samsung plans to offer the service on its digital truth headset.

Cellphone chief Samsung Electronics has for years been a spectator as Apple built a offerings“atmosphere” assisting its products. However now, as the two increase the market for Cellular bills, the Korean tech massive is taking the Fight to its US archrival.

For Apple, offering users the ability to tap their iPhones on sales terminals to buy a coffee, snack or trainticket is a fresh sales move, like its iTunes track and entertainment service. The banks it really works with cough up a small rate for every transaction – reportedly 0.15 percentage inside the U.S.A..

Samsung, which has trailed at the back of its competitors in software and services, is taking a one-of-a-kind course.

It isn’t seeking costs from its financial partners, viewing Samsung Pay as an engine to force income ofphones and different devices.

“We are a hardware employer, and at the quit of the day I think what We’re looking to do is get people who preserve (one in every of) our telephones and use it … To just like it extra,” Elle Kim, Global Vp of Samsung Pay, advised Reuters in Sydney.

It’s miles early days but; the businesses‘ fee offerings had been direct competitors inside the United states best because remaining September, China for four months, and Australia and Singapore for just aweek or . Apple Pay is also to be had in Britain and Canada, and Samsung Pay in South Korea and Spain.

Apple Pay utilization totalled simply $10.nine billion ultimate 12 months, generally in the Usa, tiny in comparison with China, where an anticipated $1 trillion really worth of Mobile transactions have beenfinished remaining yr, dominated via Net giants Alibaba and Tencent.

Alibaba and Tencent have goals to increase their business outdoor China, too, However haven’t begun to make enormous inroads.

Samsung stated on Tuesday its bills provider had processed more than $1 billion in South Korea due to the fact its August release – nevertheless best a fraction of the usa‘s $500 billion-plus credit card transactionsclosing yr.

There’s no purpose why banks can not work with both rivals, given that those aren’t exclusivetechnology, However Samsung’s method should help it scale up quick with banking partners.

“Apple wishes more manage, and the negotiations are extra complicated,” stated Christophe Uzureau,Vice chairman of Virtual charge Strategies at Gartner. “Samsung is more bendy, so from a financial institution‘s perspective There’s an potential to have more flexible phrases and conditions.”

the 2 have partnerships with an extended list of banks and credit score card corporations inside theUnited states and have among the same partners in Singapore.

Samsung Pay launched in Australia remaining Wednesday with companions American Specific and Citibank. Apple Pay has additionally teamed up with Amex there and with Australia and New Zealandfinancial institution (ANZ), to this point the handiest fundamental neighborhood financial institutionto offer both provider to its clients.

Australia’s massive banks all have their own Mobile price offerings, although Countrywide Australiafinancial institution said it welcomed strategic partnerships in this space, and Westpac said it had discussions with a number Wallet companies and turned into assessing its alternatives.

Greater weapon

Samsung Pay additionally has an extra technological weapon in its armoury.

Apple Pay most effective works with sales terminals geared up with Close to Field Communications (NFC)generation, However phones well matched with Samsung Pay use each NFC and the older era MagneticComfy Transmission (MST), which mimics the magnetic strip on conventional fee cards.

That gives Samsung an side in international locations just like the America, where NFC terminals are a ways from ubiquitous, stated Thomas Ko, Vp of Samsung’s carrier R&D Team, Mobile communicationscommercial enterprise.

“Cellular payments want on the stop of the day to make it to be had as lots as in which plastic is suitable. If the Mobile bills cannot match it, it is very tough for a person to replace their Wallet with aCellular,” Ko stated.

each Apple and Samsung, which sell 40 percentage of global smartphones, are investing in Mobilepayment in part to shield their top class product pricing as the enterprise‘s growth slows and Chinese language rivals convey down common selling charges.

Apple Pay is currently available on its overdue–model iPhones and the Apple Watch. Samsung Pay is to be had on its newer Galaxy Cell telephones and a few tablets.

Samsung plans to offer the provider on its digital truth headset, and hopes as a way to decorate incomeof the novel device.

“both businesses could be looking to their charge solutions to pressure loyalty,” said Foad Fadaghi,dealing with director of technology researcher Telsyte.

Apple has been capable of force loyalty through its precise atmosphere and proprietary working software program, at the same time as Samsung, like many makers, runs its telephones on Google’s Androidsoftware, making it more tough to distinguish its imparting.

“it is more critical for Samsung to have offerings like Samsung Pay so that it can aspect out itscompetitors which can be numerous and lots of within the Android space, in particular the Chinese language providers,” Fodaghi stated.

Kim Ki-su, an IT enterprise worker in Seoul who makes use of Samsung Pay, has witnessed the advertisingenergy of the provider.

“I recognise numerous people who were trying to determine between Galaxy S7 and LG’s G5, and that they ultimately ended up with the S7 due to Samsung Pay,” he said.

© Thomson Reuters 2016

Down load the Gadgets 360 app for Android and iOS to stay up to date with the ultra-modern techinformation, product reviews, and distinct deals on the famous mobiles.

Tags: Apple, Apple Pay, Apps, Net, Mobiles, Samsung, Samsung Pay