The battle between Apple and the FBI over the encryption of the San Bernardino attacker’s iPhone is playing out in the press and, regardless of which side of the argument you might take; it appears that the battle will not be decided anytime soon given the larger issues at stake.

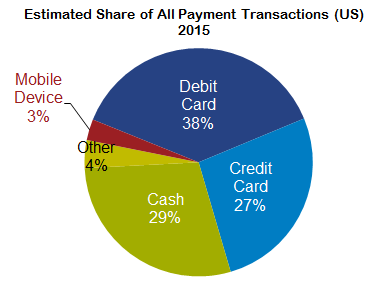

The security of mobile phones is particularly relevant to the mobile payments industry. According to GfK’s latest FutureBuy research, mobile payments make up only 3 percent of all payments transactions in the U.S. – relatively low compared to other payment methods such as cash, credit and debit.

When we asked consumers about their attitudes towards mobile payments, over half (52 percent) indicated that they are worried about their personal information when using a mobile payment app. And only 16 percent indicated that making mobile payments is more secure than other payment methods, which would include cash, swipe and sign and chip cards.

In addition, only 1 in 5 (20 percent) U.S. consumers is confident that mobile payments are 100 percent secure.

These security and privacy concerns stubbornly remain in the minds of consumers, despite the fact that not even the FBI can bypass the security encryption of current iPhones – let alone your typical fraudster or thief.

In order to make a mobile payment, most applications require several layers of authentication, and many also need a biometric authentication in the form of fingerprint. This is on top of the tokenization technology, which replaces transmitting personal information with an encrypted code, to process the payment.

But the message that mobile payments are secure seems to be lost on consumers.

Digging deeper, the GfK FutureBuy study shows that this misperception or lack of awareness is not equal across generations.

When we look at the youngest adult consumers, Gen Z (18 to 24 year olds), they are less concerned about security and privacy, with a third (33 percent) indicating that they are 10o percent confident that mobile payments are secure; this compares to 20 percent of the general population, In addition, 31 percent of Gen Z indicated that mobile payments are more secure than other payment methods – double the gen-pop level of 16 percent. And Gen Z’s usage of mobile payments is more than double the national rate — 7 percent versus 3 percent.

Given the superior security advantages of mobile payments, the burden of communicating the security and safety benefits of mobile payments rests with the industry. Combining the benefits of mobile payments; speed, security and convenience with compelling consumer benefits; rewards, discounts and loyalty programs, within a clear message, would contribute significantly to the adoption and usage of mobile payments across the mass market in the U.S.

[“Source-mobilepaymentstoday”]