Samsung Electronics gained almost a five percentage point market share in the Indian smartphone market in Q4 2015, commanding a leading 26.8% share in the growing market. According to the ‘Brand Trust Report 2016’, Samsung mobile has emerged as India’s most trusted brand, with the highest confidence level among consumers based on a survey on brands conducted in 61 cities of the country. India is the second largest smartphone market in the world in terms of the active unique smartphone user base, which is more than 220 million. However, with smartphone penetration at 30 percent of the total population, there is huge growth potential in the region, which is attracting several players such as Chinese vendor Xiaomi and other local players. While competition is intense in this market, with a leading market share and high consumer confidence, Samsung is well-poised to capture the growing smartphone market in the region and India could boost its mobile phone revenues in the future.

Smaller Cities Will Drive Smartphone Market In India

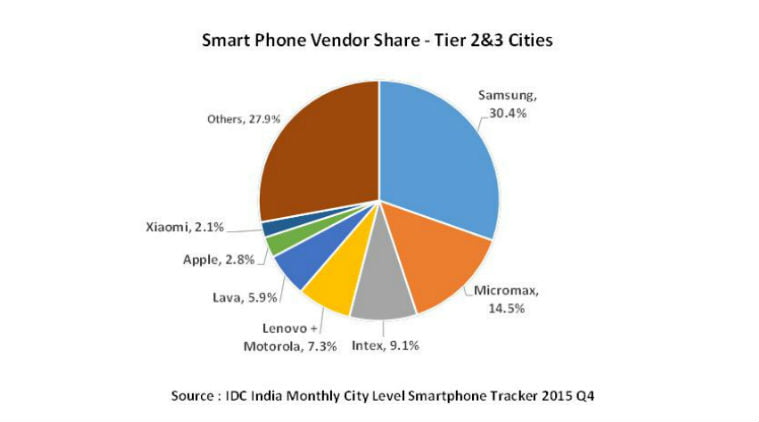

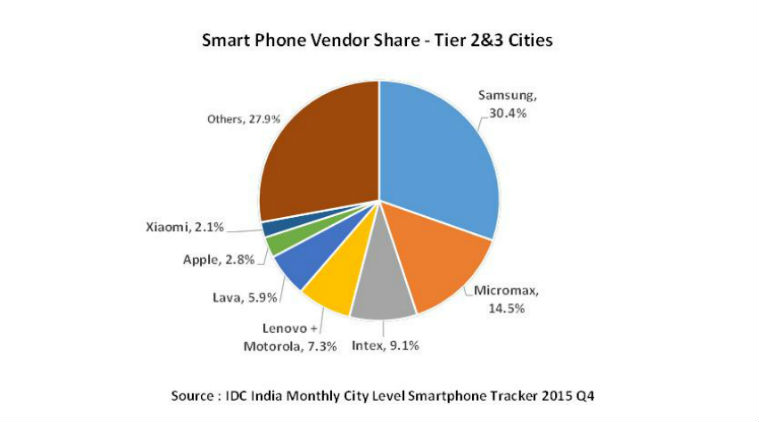

According to the latest report from IDC, tier 2 and tier 3 cities will spearhead the next wave of growth in the Indian smartphone market. Currently, 25 major small cities make up approximately 20% of the smartphone market in India, and there is a trend of migration from feature phones to low-end smartphones in these cities. Samsung has a leading market share in these areas, and should benefit from the next wave of demand of smartphones from these smaller cities.

According to a study carried out by US-based market research firm iGR, smartphones are forecast to constitute 98% of total mobile phone sales globally by 2020. The Indian smartphone market witnessed a nearly 30% increase in shipments in 2015 compared to the previous year, making it one of the fastest growing smartphone markets in Asia Pacific. This growth has attracted several players to the market, including Chinese vendors such as Xiaomi making the space intensely competitive. Although Samsung was successful in gaining a 5% market share in India from its rival Micromax, it needs to maintain its leading position in smaller cities to ride the wave of smartphone growth in India.

The premium smartphone segment accounts for only 4% of the total Indian smartphonemarket, and Samsung and Apple together control 90% of this market. According to Counterpoint, this segment grew by 40% in the quarter ended December 2015 and it was Apple’s best-ever quarter in India with over 800,000 iPhones sold. This segment is expected to double in 2016, and Samsung is likely to face intense competition from Apple. Samsung can tap into the growth in India in both the profitable premium smartphone segment and the lower end models, which can drive revenue by leveraging its brand popularity in the region. According to our estimates, the mobile phone segment accounts for more than 25% of Samsung’s valuation and we expect steady growth in the total phones sold by the company globally despite its lost market share.

[“Source-forbes”]